QUESTION: Can you explain why our rates will be so high…even if we participate in the PREPAYMENT PROGRAM?

ANSWER: Let’s use three slightly modified graphics from our June 12th Public Information Meeting. This will explain both our current rate and our future proposed rates. Please remember that these future rates are ESTIMATES. Final rates will be determined by the terms of our loan agreement that we need to finalize to pay our debts.

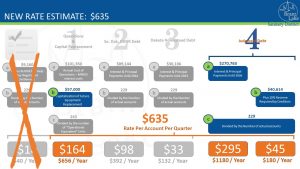

1) Our Current Quarterly Rate ($275 / $245 with ACH Discount) — Our current rate was set as part of our efforts to negotiate a settlement with Excel Underground. When we set the our current rates we were striving to show maximum local effort in raising money and so we set our rates at a level that would be the ‘highest in the state”. We also offered a $30 discount to any account willing to pay via ACH. Since most accounts have chosen ACH payment, let’s look at the discounted rate of $245. Columns 1, 2, and 3 of the first slide are the “expense driven” elements of our $245 rate. Then there is an additional $10 per quarter per account to help pay for a settlement – which we were unfortunately not able to negotiate successfully.

2) Our ESTIMATED New Quarterly Rate ($635) — Everything element that remains the same as our current rate has been shaded gray and new elements are in bright blue and orange. The changes include…

- First, the $10 per quarter “excess” for a negotiated settlement is eliminated;

- We have added the Capitalization Reserve which is required for future infrastructure replacement. As explained in other emails, this is a low estimate of what will be necessary and it has not been addressed in previous rate structures;

- We then have an estimated $295 per quarter for judgment debt and $45 per quarter for contingency as required by creditors.

3) Our ESTIMATED New Quarterly Rate w/ DISCOUNT ($340) –And then finally, if participating in the Prepayment Program, the $295 portion of the quarterly rate will be discounted from future bills. The Prepayment Program ONLY impacts this portion of the bill. These discounts continue for the duration of our loan payback period — estimated to be 15 years.